Can we afford to die these days?

ADVERTISEMENT FEATURE

Do you ever worry about the cost of living? Have you ever thought about the cost of dying? Whilst it probably isn’t a subject we want to think about, perhaps we should.

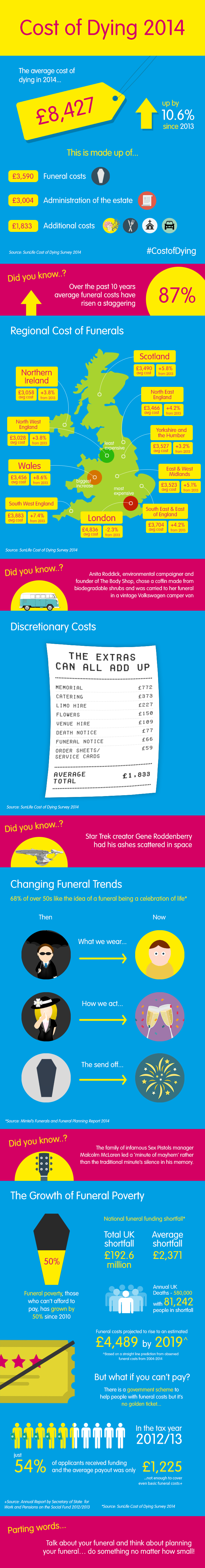

According to SunLife’s latest report, the total cost of dying in the UK rose 10.6% last year to £8,427 1. – that’s a rise seven times greater than the cost of living.2

What’s this cost made up of?

You’d be forgiven for thinking that £8,427 sounds excessive, but when you look at the individual components, you can see how the costs add up:

1. Funeral costs – average price £3,590

This figure includes the fees for a funeral be it a cremation or burial, the coffin, hearse and the service itself.

2. Estate administration – Average price £3,004

This is the average cost of using a professional to administer the estate, the process known as probate. About 40% choose to hire someone rather than doing it themselves.

3. Extra, optional costs – Average price £1,833

These are the costs of the more personal elements of the funeral, such as flowers, catering, hiring a venue, death notices, and a memorial.

You can see from this that the biggest single outlay is for the funeral itself. It’s hard to believe, but since SunLife’s first survey in 2004, the average cost of a funeral has gone up by a massive 87%.

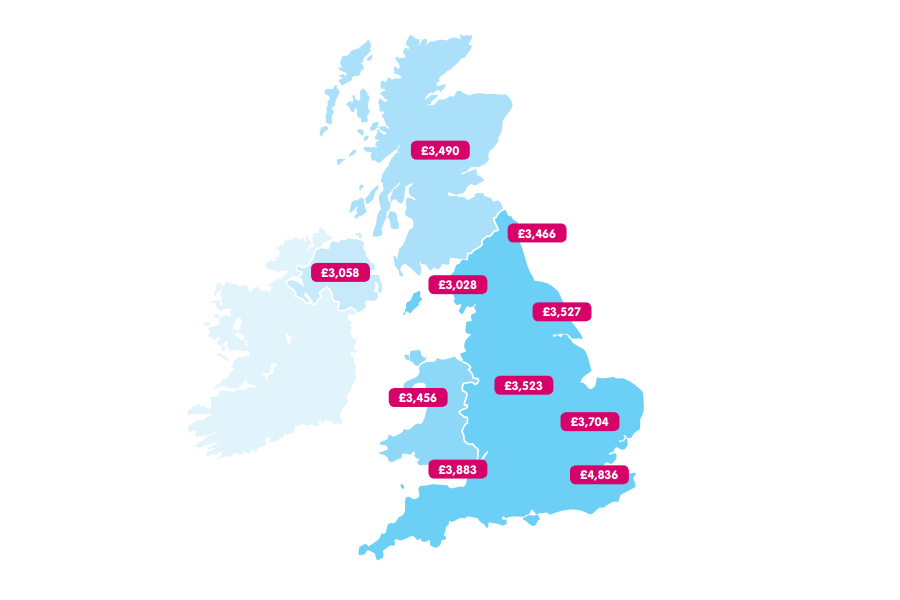

The costs in your region

So far, we’ve talked about the average costs across the UK, but like many things today, the cost of dying will vary depending on where you live (or die).

The difference in costs across the country can be stark. For example, in London the average cost of a funeral stands at £4,836 – nearly 35% above the national average of £3,590. At the other extreme, the average cost in North West England is considerably lower at £3,028 – that’s almost 16% below the national average.

Differences in other parts of the country aren’t quite as dramatic with one notable exception – burial costs. These vary significantly from region to region.

Tough times and changing times

But not every element of the total cost of dying is on the up. Since last year, the average amount spent on additional extras like flowers, the wake and orders of service, fell by £173 to £1,833. As these elements are very personal and unique to each funeral, the average combined cost does tend to fluctuate from one year to the next.

In such times of austerity, it’s understandable that we might be spending less in this area but technology could also be making a dent in these costs. Social media’s huge impact on every part of our day to day lives now goes as far as the funeral arrangements.

Where once the done thing was to place funeral announcements in the newspaper, today we’re frequently turning to Facebook to announce a funeral and receive condolences.

Funeral poverty on the rise

With so many costs to be covered, it’s not surprising that more and more people are struggling to foot the funeral bill. Funeral poverty, those who can’t afford to pay, has grown by 50% since 2010 in the UK, with the average shortfall now over £2,300 on average.

Planning ahead can make a difference

Sadly it seems funeral poverty is here to stay. Funeral costs have consistently risen over recent years and show no sign of stopping. With this in mind, getting some plans in place could make a real difference. Having money put aside to help pay for your funeral can only help ease the burden on our nearest and dearest when they need it most.

Planning ahead also helps ensure our wishes are met and that our funeral is as we would want it. Be it a traditional service, or something more in line with current funeral trends, such as a more colourful celebration of life.

Want to start making plans, but not sure of the next step?

If you’d like to help loved ones with your funeral or are thinking about a funeral plan, download our free guide – How to Plan for your Funeral.

If you’d like to know more, take a look at SunLife’s Cost of Dying Report 2014 or see how prices have changed in your region by using our free funeral cost calculator.

SunLife offer Funeral Plans, Will writing services, ISAs, Over 50s life insurance and Term Life Insurance. For more information, visit www.sunlife.co.uk.

1. All figure quoted, unless otherwise stated: SunLife Cost of Dying Survey – July 2014

2. The rate of consumer prices index (CPI) inflation for the year in the UK was recorded at 1.5% in August 2014 (Office for National Statistics)

All figure quoted are from the SunLife Cost of Dying Survey – July 2014

SunLife is a trading name of AXA Wealth Services Ltd which distributes financial products and services. AXA Wealth Services Ltd is a company limited by shares and the registered office is at 5 Old Broad Street, London EC2N 1AD (registered in England No. 02235458). AXA Wealth Services Ltd is authorised and regulated by the Financial Conduct Authority and is entered on the Financial Services Register (registration No. 465753).

Latest posts by Sally - Silversurfer's Editor (see all)

- Do you sleep with a snorer? - April 25, 2024

- Holiday hack: How to win a GHA DISCOVERY Titanium status upgrade - April 23, 2024

- 10 Money saving tips for gardeners - April 21, 2024

- Should smacking a child be banned in England and Northern Ireland? - April 17, 2024

- Enjoy the best of the UK on a Shearings coach holiday - April 17, 2024