April 2016 – State Pension changes

The State Pension is changing, and it is important to know what the changes mean for you.

Have a look at this 30 second video which explains how State Pension works: [State Pension changes explained]

If you already have your State Pension then the changes won’t affect you, you will just keep receiving your pension like normal. But if you reach State Pension age after 6th April 2016 then you will get the new State Pension. This means you need 35 years of National Insurance contributions to get the full amount (at least £150 a week) or your need at least 10 years to get any State Pension at all.

If you want to check your National Insurance record, then just visit www.gov.uk/check-national-insurance-record

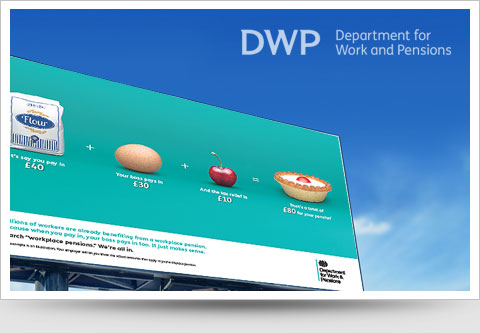

The State Pension is a good foundation for your retirement, but you may want more money depending on your lifestyle. Saving into a personal or workplace pension, and having some savings too, are the best way to make sure you get the lifestyle you want.

Still confused?

• Watch this video which explains all of the changes [New State Pension]

• Read our 5-minute guide to the State Pension below

A 5-minute guide to State Pension changes

We like a challenge, so we decided to explain the changes to the State Pension to you in 5 minutes. Timers ready…

What is the new State Pension?

The State Pension is changing for anyone reaching State Pension age on or after 6th April 2016. Instead of the previous complicated multi-tiered system of basic and additional State Pension, the new State Pension will be clearer and easier to understand.

Will everyone receive the full rate of the new State Pension?

No. This is a myth. Not everyone will get the same amount. What someone receives will still depend on their National Insurance (NI) record – the NI contributions a person has made or been credited with. But you can get credits when you are raising a family, caring, or even if you look after the grandkids.

What is the full rate of the new State Pension?

The full level of the new State Pension will be more than £150 per week but the exact rate will be set next year before it is introduced.

Why is it being replaced now?

The old pension was complex, made it confusing for people to save, and left many not getting additional payments.

Under the new system, women, carers and self-employed people who haven’t previously received much by way of an additional pension are likely to benefit from a higher state pension.

In the first 10 years, about 650,000 women are set to benefit from the changes, getting on average £8 a week more in State Pension.

Will people be better or worse off under the new State Pension?

A lot of people stand to gain from the new State Pension, especially self-employed people and women. In fact, around three-quarters of people reaching State Pension age in 2020 will have a higher State Pension under the new system.

Is it true that not everyone will get the full new State Pension?

Yes, just like with the old system, what you receive depends on your NI record. So people without a complete National Insurance record may not get the full amount.

But many people will end up with more under the new system, even if they’re not getting the full rate.

If you retire in the years after April 2016, the government will calculate what you would receive under both the old and new systems – and then give you the higher!

What happens if you don’t work while looking after children or have a caring role?

Depending on your circumstances if you are a carer or parent you may get NI credits, which contribute towards your State Pension.

Click here to find out more https://www.gov.uk/national-insurance-credits

Can you increase the payments by putting off your State Pension?

Yes, you can increase the amount of State Pension you get by “deferring” your claim. In fact, your State Pension will be automatically deferred until you choose to claim it.

Click here to find out more www.gov.uk/deferring-state-pension

Is the state pension age changing?

Yes. You can find out when you will reach State Pension age by using the State Pension calculator here www.gov.uk/calculate-state-pension