January 2015 – Automatic enrolment

Back in 2012, only 1 in 3 people were saving into a workplace pension, meaning that most wouldn’t have enough to fund their retirement. So the government decided to ‘automatically enrol’ them into a workplace pension.

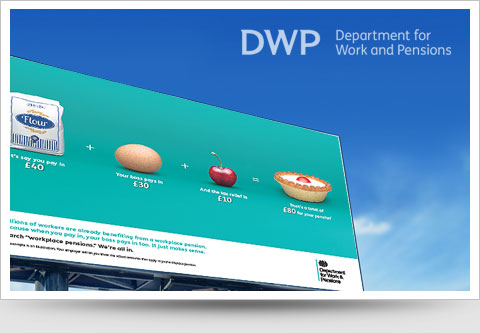

This means that you contribute a small percentage of your pay, your employer pays in too, and the government gives you tax relief—meaning that you get a bigger pension pot than if you went it alone. We like to think of the equation a bit like this…

Auto-enrolment applies to everyone aged over 22, who is in work and earns over £10,000 a year. So the likelihood is that you have been or will be auto-enrolled. And seeing as 9 out of 10 people stay enrolled in their workplace pension, you probably stayed in too. Good choice!

If you want to see what sort of retirement your pension could get you – take a look at this video! [Meet Derek the ultimate #PensionFan]

If you want more information about auto-enrolment:

Visit www.gov.uk/workplacepensions

Visit www.youtube.com/pensiontube

Or ask your employer.

| Myth I’m relying on my partner or I’ll inherit money from my parents |

Busted Inheritances can be uncertain and as people live longer you may have to wait longer for money you’ll be relying on. Your parents could still be alive when you retire. You need to make your own pension arrangements. |

| Myth It’s not worth saving into a pension |

Busted Oh yes it is. We all know that pension savings can go down as well as up. But analysis of the industry shows 95 per cent of people can expect to get back more during their retirement than they put in |

| Myth My house will be my pension pot |

Busted Be wary because property doesn’t allow you to spread your money across a range of different investments in the way saving into a pension does. And you don’t have the same tax advantages or contributions from your boss. |

| Myth I can only pay a small amount so it’s not worth it |

Busted Your contributions may be a small percentage of your salary but you will also benefit from extra money with contributions from your boss and through tax relief. Saving regularly and starting as early as possible will enable you to build up a pot to help give you a more secure financial future. |

| Myth I’ve left it too late to start saving |

Busted It’s never too late to start making contributions. Better late than never. And if you don’t you’ll be turning down extra money from your employer and tax relief. |

| Myth My grandma only lived to 70, I won’t live much longer. Why bother? |

Busted People tend to underestimate how long they are going to live and life expectancy keeps rising. We are likely to spend an average 20 years in retirement, so you do need to put something away for that. |

Have you been auto-enrolled? Did you stay in or opt-out? Let us know in the comments.