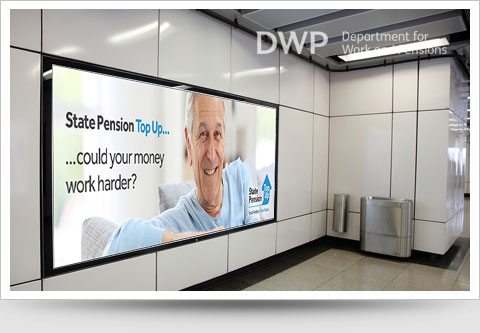

October 2015 – State Pension top up

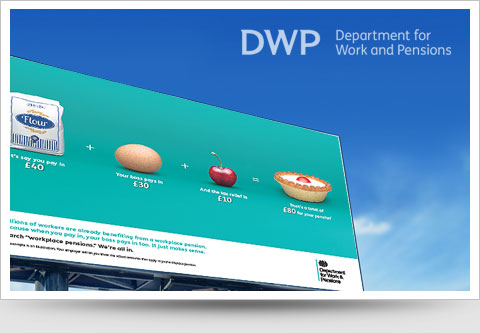

There’s still no such thing as a free lunch, but there are some good investment options out there. In October 2015 the government launches a new scheme where you can buy between £1 and £25 a week extra on your State Pension. You simply pay a lump sum and you get the income back, for life.

It doesn’t apply to everybody though, so we’ve made a simple ‘top up’ checklist so you can decide if it is right for you…

✓ Available to anyone who reaches State Pension age before 6 April 2016 and is entitled to State Pension

✓ Boosts State Pension payments by between £1 – 25 extra a week upon payment of a lump sum

✓ Provides guaranteed income for life

✓ Inheritable by surviving spouses

✓ Payments rise with inflation

✓ Same rates for men and women

✓ Available from October 2015 to April 2017 only

Pre-register your interest now to receive more information about State Pension top up from the government. Just email [email protected] with the title ‘Interested in State Pension top up’.

Still not sure? Watch this video where freelancer Philip Morgan, 66, explains why topping up his State Pension is a good idea for him. [State Pension top up: why Philip thinks it’s a good idea”]

There are many more videos on PensionTube – a new YouTube channel which is ‘cutting out the jargon’ on pensions. Visit www.youtube.com/pensiontube to watch more.